Looking for one of the top, Australian regulated, Forex brokers in the World?

Reviewer: Stuart Young

Last Updated: 2nd November, 2023Array

Today I’m reviewing OANDA Australia (OANDA Australia Pty Ltd) FX trading broker. I’m proud to include an OANDA review on our site as they are not only one of the most recognised names in the Forex market, but it’s hard to find a more respected Forex broker, than OANDA is in the foreign exchange industry.

Many traders who have been around Forex for a while will also be aware of the extremely popular OANDA currency converter and the OANDA historical exchange rates apps.

Below is my review of OANDA’s offerings in Australia, to assist currency traders in answering the question, is OANDA a good broker for their trading needs.

Review Summary:

- Excellent award-winning client service and support

- Award-winning educational material and trader education

- Transparent pricing with no order rejections, no re-quotes and no "last look"!

- Competitive spreads on all instruments offered

- Lightening fast execution speeds. In fact, Oanda has the fastest documented execution speeds I have seen from any Forex broker

- One-on-one trader education available for premium clients!

As part of this OANDA review I met in person with David Villagra (Director of Institutional Sales & Education) at OANDA Australia and confirmed David himself provides the one-on-one mentoring for premium clients. This is extremely rare in the forex broker industry - Two of the industries benchmark online forex trading platforms are available, MetaTrader 4 (MT4) & OANDA's proprietary fxTrade

- Large variety of currency pairs to trade (over 70 different Forex pairs to choose from), 23 metals plus 30 index, bonds and commodities CFDs

- OANDA does not use client money for hedging or any other operational purpose

- Advanced charting and trading tools, such as Currency Strength Heatmap, available to all clients

- Traders can automate their trading strategies using OANDA's REST & FIX APIs

- One of the foreign exchange industries most respected brokers, both from FX traders and their broker peers!

- Does not offer CFDs on equities. This will not be an issue for traders if they don't require stock/share CFDs and Oanda's Range Of Instruments is excellent on the Forex with over 70 currency pairs to trade, plus a wide range of metals and CFDs in indices, bonds and commodities

- Does not offer CFDs on cryptocurrencies. While cryptocurrency and blockchain assets are increasing in popularity, this will not be an issue for traders if they don't trade cryptocurrencies

- Their standard Forex trading account variable spreads are higher on average than their competitors in this style of account.

To fully understand Oanda's services and mission, I visited their offices in Sydney, Australia and spoke with David Villagra (Director of Institutional Sales and Education at Oanda).

After discussions with David, and fully reviewing OANDA I certainly feel they achieve this!

There are several key areas, which are important to many traders, where OANDA absolutely excel:

- Excellent award-winning client service and support;

- Incredibly transparent pricing with no rejections, no re-quotes and no "last look";

- Cutting-edge trading technology with the fastest documented execution speeds I have seen; and

- Award-winning education resources with true support for new traders and, one-on-one training is even available for premium clients for a more personal level of trading help. I can't stress how rare this is in the forex broker industry.

I have been a trader myself for over 10 years and hearing the way David, who is the Director of education at Oanda, approaches trading in general and the foreign exchange brokerage industry was so refreshing and those taking advantage of learning from him are in the unique position of learning from a genuine trader who understands what it really takes to succeed in this competitive industry.

Our review of OANDA Australia shows in a variety of ways that they actually want their clients to become successful self-directed traders. OANDA's transparent pricing model is such that they do not profit from losses a trader may have as some other brokers in the industry do.

OANDA has won a variety of excellence awards both from within the industry and from clients.

Get started now or try the OANDA demo trading account.

OANDA Review Detail: Australian regulated Forex broker

- OANDA Australia ensures all client money is held on behalf of clients in a segregated bank account with the National Australia Bank (NAB).

OANDA does not use client money for hedging or any other operational purpose, unlike some other Australian forex brokers. - In Australia, OANDA is a licensed CFD and Forex broker. OANDA Australia Pty Ltd, ABN: 26 152 088 349, holds an Australian financial services licence (AFSL) No. 412981 and is regulated by the Australian Securities & Investments Commission (ASIC). They have an office in Australia at Level 43/225 George St (Grosvenor Place), The Rocks in Sydney and are audited by top tier firm KPMG.

- Parent company has been operating for over 23 years. OANDA Australia Pty Ltd is a part of OANDA Corporation which was established in the US in 1996, and includes several companies rendering financial services to both private traders, professional brokers and corporate foreign exchange solutions across the globe.

- OANDA is a well-capitalised foreign exchange broker, who provides consistent regulatory compliance across all regions they operate. OANDA broker also offers OANDA Rates™, a corporate solution that helps the world’s leading audit firms, taxation authorities and MNCs mitigate currency risk, optimise working capital and improve efficiencies.Further examples of OANDA being a credible, global leader in retail trading and corporate foreign exchange solutions is OANDA being named as a trusted source of currency rates by the Canada Revenue Agency (CRA), which is responsible for administering tax laws and various social and economic programs via the tax system for the Canadian Government. This essentially means that the government of Canada now includes OANDA as a trusted provider of FX rates, alongside the central bank.

Exceptional execution speed! OANDA’s new V20 all execution engine now executes trades in just one millisecond (that’s around 1/300th of the blink of an eye) with no re-quotes. Any trader who has experienced slow execution speeds or re-quotes while trying to place a trade with other brokers will be astounded at how fast OANDA is. After all, execution speed affects the price you pay.

Exceptional execution speed! OANDA’s new V20 all execution engine now executes trades in just one millisecond (that’s around 1/300th of the blink of an eye) with no re-quotes. Any trader who has experienced slow execution speeds or re-quotes while trying to place a trade with other brokers will be astounded at how fast OANDA is. After all, execution speed affects the price you pay.

These execution speed numbers are calculated on the median round trip latency measurements from receipt to response for all Market Order and Trade Close requests executed between 1st August & 30th November 2017 on the OANDA V20 execution platform, excepting MT4 initiated orders.- No re-quotes. OANDA does not requote orders that are executed at the valid market price when the request is received at their server. No automated rejections are possible. Market orders only fail to be executed if they fall outside the upper/lower bounds that you choose to place to protect against price fluctuations, or if you have insufficient funds to execute your trade.

On the OANDA web site they confirm We honour all quotes without re-quotes or rejections. No one at OANDA has the ability to target your positions, hunt your stops or change your pricing… No rejections, no re-quotes and no “last look”.

OANDA Trading Platforms – fxTrade and MT4

- OANDA specialise in two key platforms, their proprietary fxTrade trading platform and MetaTrader 4 (MT4).

The fxTrade platform is easy to use and accessible on the following devices:- OANDA fxTrade desktop;

- OANDA fxTrade web (login via their web site); and

- OANDA fxTrade mobile.

For new currency traders interested in OANDA broker, we recommend trying an OANDA fxTrade practice / demo account first to familiarise yourself with the trading platform’s features and navigation before moving to a live trading account.

For new currency traders interested in OANDA broker, we recommend trying an OANDA fxTrade practice / demo account first to familiarise yourself with the trading platform’s features and navigation before moving to a live trading account. - When viewing the OANDA demo account it was pleasing to see how easy it is for traders to place an order. Adding your stop loss or other advanced order types is very easy to do at the time of placing your initial order.

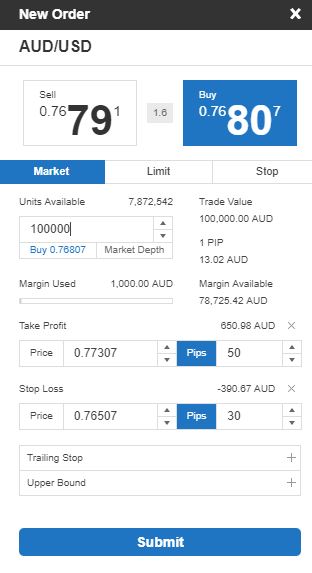

I was pleased to see that the deal ticket clearly displays the values of your trade in the base currency of your account (see screen shot of the OANDA AUD USD deal ticket taken from an fxTrade demo account).For example, if your account base currency is AUD then the deal/trade ticket shows the AUD value per pip your currency pair moves. In addition, the total AUD value you are risking based on the entered stop loss (which is great for proper risk management), and potential profit based on your entered “take profit” level or pips are displayed.

- Advanced charting and trading tools. OANDA broker offers innovative trading tools including:

- advanced drawing & charting;

- over 100 technical indicators;

- automated technical analysis such as highlighting technical trading patterns (as per the image to the right), which is great for new or beginner traders;

- price alerts;

- trader sentiment; and

- market commentary to all account holders.

- Trade direct from your charts. This is a feature many technical traders look for in a trading and charting platform. Oanda’s platform allows traders to place, view, and close Orders and Trades, including Stop & Limit Orders, directly from your charts using the optional Buy/Sell panel or by right clicking on your trading chart.

- For advanced traders, application program interfaces (APIs) are available. Using an OANDA API allows you to develop automated CFD and FX trading strategies. The current APIs, http-based REST and Financial Information eXchange (FIX), provide access to real-time trading capabilities and automation of your order execution. OANDA’s REST APIs will be best suited to individual traders looking to fully automate their trading strategy.

Markets to Trade and OANDA Spreads Comparison

- There are over 100 financial instruments available to trade at OANDA. These include:

- Large selection of currency pairs, including FX majors, minors and exotic FX pairs);

- CFDs (contracts for difference) on indices, commodities and bonds; plus

- precious metals CFDs (gold, silver & platinum).

- OANDA are incredibly transparent with their pricing and their forex spreads are competitive in the FX industry. Testament to their pricing transparency, there is an Oanda Historical Spreads graph which is available for everyone to see on the internet.

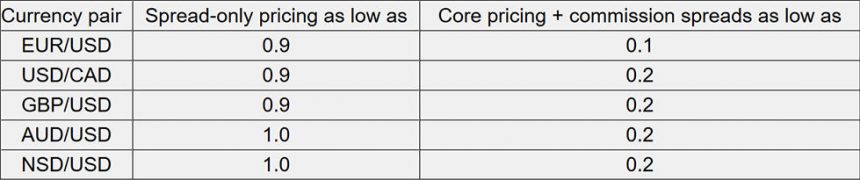

I am not aware of any other broker that provides this level of transparency around their spread pricing! I am impressed by this, as if all brokers were forced to provide such information it would make comparisons for potential clients much easier by truly comparing “apples for apples”. - Below is a comparison of OANDA spreads on some major pairs for their spread-only vs core pricing account

- As of 13th February 2018, OANDA’s CFD spreads have been reduced on key global indices. Index traders can now access tighter spreads during local market hours (cash market) as per the following:

- Australia 200 spread from 0.8

- UK 100 spread from 0.8

- Germany 30 spread from 0.9

- US Wall St 30 spread from 1.6

- US NAS 100 spread from 0.5

Customer and Broker Industry Awards

- OANDA, including OANDA Australia Pty Ltd, has won several industry and client CFD and Forex broker awards in recent years including:

Highest Overall Client Satisfaction – Investment Trends FX Report 2016

Highest Overall Client Satisfaction – Investment Trends FX Report 2016- Best Value for Money – Investment Trends FX Report 2016

- World’s Best Retail Forex Platform – Winner at FX-Week e-FX Awards 2016

- Best Educational Materials – Investment Trends Australia FX Report 2015

- In 2017 OANDA won the Best Forex Trading Technology award at the prestigious UK Forex Awards run by leading industry publication Shares magazine

[starbox id=6]

Foreign Exchange (Forex) and Contracts for Difference (CFDs) are a complex, leveraged financial product and requires a certain level of experience, so may not be suitable for everyone. Forex trading carries a high level of risk to your capital. Losses can exceed your initial deposit and therefore you must ensure you fully understand all the risks involved.

All broker reviews are conducted independently by Online Brokers Australia. If you are considering acquiring any of the financial products listed on this Oanda review web page, you should always read the Product Disclosure Statement (PDS) and other offer document/s before making any investment decisions. If you are unsure of the risks, or have any doubt whether you have sufficient financial resources or experience to trade these OANDA Forex products, you should take professional advice before trading.