Looking for the largest, Australian regulated, CFD provider?

Today I’m reviewing IG Australia (ex IG Markets Australia) CFD trading broker and part of the IG Group. I specifically wanted to include an IG review as it’s possibly one of the most recognised names in the CFD market. The reason for this is they are the longest established CFD provider in Australia (since 2002) and are listed as both, the world’s, and Australia’s largest retail CFD provider, as well as Australia’s leading FX provider*

I therefore wanted to include a review of IG’s offerings in Australia.

IG Review Summary:

- Largest retail CFD provider, both in Australia and the world *

- Does not use client money for hedging or any other operational purpose

- Negative balance protection

- Widest variety of international markets, including binary options & very unique markets

- Direct Market Access (DMA) pricing available on share CFDs & FOREX

- Very easy to use trading platform

- Great charts & innovative alerts available

- Excellent mobile trading apps

- Longest established CFD provider in Australia

- IG is the most-used CFD provider among Australian CFD traders, and has market share double the size of its nearest competitor *

- IG's share trading now offers a wide range of equities via a separate account. Over 12,000 shares are available from Australia, US, UK, Germany and Ireland.

- Fees and spreads are slightly higher than some competitors on standard instruments like indices & ASX share CFDs, however in late 2017 they reduced the spreads on the majority of Forex pairs which are now extremely competitive

- For DMA pricing, users must manually activate this option. Please note this is not really a "con" however I have added it in this section as clients may not be aware of this and is a subsequent step they must perform to receive IG DMA

IG Australia CFD broker is most suited to those looking for the widest variety of instruments to trade. This is particularly the case if you require a wide variety of CFDs on binary options, bonds, interest rates, or even some very unique markets such as IPO grey markets, Bitcoin, and ETPs (Exchange Traded Products).

IG Australia CFD broker is most suited to those looking for the widest variety of instruments to trade. This is particularly the case if you require a wide variety of CFDs on binary options, bonds, interest rates, or even some very unique markets such as IPO grey markets, Bitcoin, and ETPs (Exchange Traded Products).IG is also suited to index traders who need the ability to place trades on the FTSE 100, Germany 30 and Wall Street indices out-of-hours on a Sunday. While this would not be a common requirement for many CFD traders, IG Australia does offer this service allowing you to offset 'standard' weekday trading positions, reducing your margin requirement and risk, if important news breaks over the weekend.

They are the longest established CFD provider in Australia (since 2002) and the parent company, IG Group Holding, has been operating for over 40 years in the UK.

It is very important to note that if direct market access (DMA) trading is an important criteria for you, IG Australia do provide this option on share CFDs and FOREX, however it is not provided as the default, and you must activate DMA within your IG Markets web-based dealer platform to actually receive it.

IG also offer a separate share trading account, in addition to the traditional CFD and Forex trading.

IG Markets are not suited to those looking for the outright cheapest brokerage rates and fees... if you want the cheapest rates please view our TradeDirect365 review instead.

However, our IG trading review has shown they are the largest, Australian regulated, CFD broker providing the widest range of contracts for difference to trade, DMA CFDs, very easy to use CFD trading platform and great real time trading charts..

IG Client Money Protection

There is nothing more important than trading with a safe and secure CFD provider.

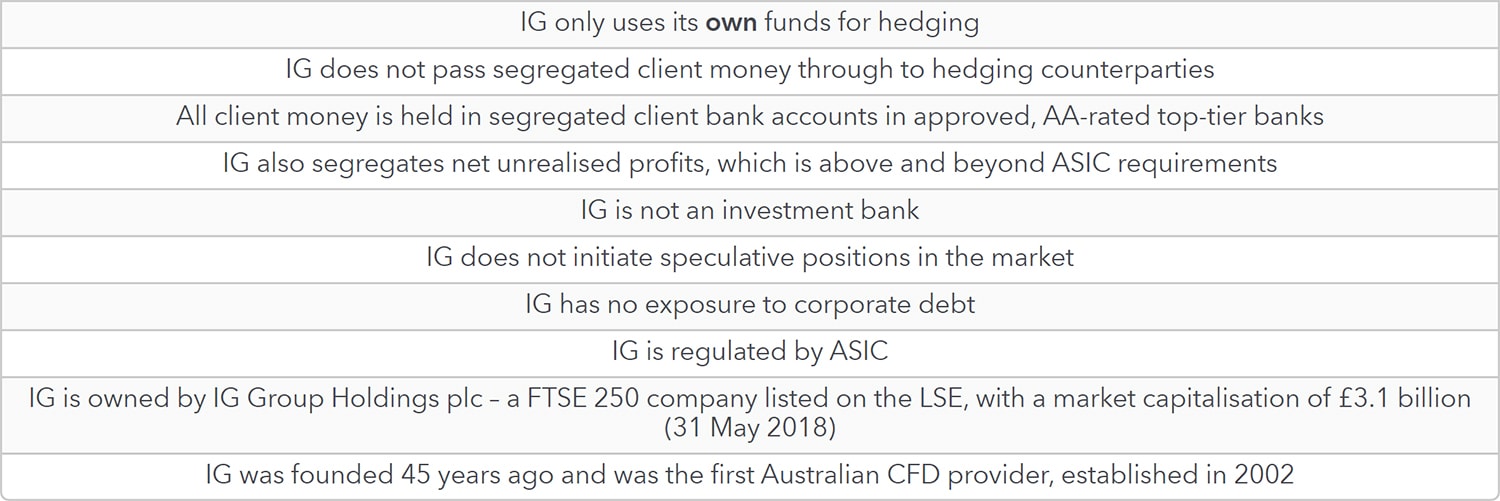

Below is a summary of IG’s position:

In addition to the above list, IG also has established a Client Money Committee which reviews and ensures the adherence to jurisdictional regulations in all IG Group entities.

They have also commissioned PricewaterhouseCoopers LLP to perform an independent review of IG’s money segregation and client money calculation procedures. This is actually above and beyond the standard audit checks and their regulators’ requirements.

Review Detail: Trading With IG Markets Australia

Australia’s largest & longest established CFD broker

- IG Markets ensures all client money, including net-running unrealised profits, is held on behalf of clients in a segregated bank account with AA-rated, top-tier Australian banks.

IG does not use client money for hedging or any other operational purpose, unlike some other Australian CFD providers. - In Australia, IG is a licensed CFD and Forex broker. IG Markets Limited, ABN: 84 099 019 851, holds an Australian financial services licence (AFSL) No. 220440 and is regulated by the Australian Securities & Investments Commission (ASIC).

- IG are well-capitalised and as at 9th September 2019 state on their web site to have a debt-free balance sheet.

IG is debt-free, with substantial liquidity and capital reserves significantly in excess of regulatory requirements.

IG broker has some impressive statistics over the last few years as reported by leading research group, Investment Trends. Investment Trends is recognised as the leading global researcher in the CFD, online share trading and retail foreign exchange markets. Their Australia Contracts for Difference Report provides in-depth analysis of the Australian CFD market. It examines the behaviours and attitudes of more than 15,000 Australian CFD traders and investors. This makes Investment Trends CFD report the largest and most comprehensive independent study of the CFD market in Australia.

The report details some impressive findings and confirmed IG is still the most-used CFD broker among Australia’s 43,000+ CFD traders. IG’s market share was confirmed to double that of its closest competitor.* The Investment Trends report highlights that Australian traders saw financial strength as one of their key considerations. IG on their web site confirm financial strength, treatment of client funds and easy to use trading platform and were key drivers for clients who selected to trade with IG during the reporting period.

-

Instruments and Trading Products

Widest variety of international markets to choose from (over 16,000 in total), including all popular indices, commodities, share CFDs from the world’s leading stock exchanges, binary options, bonds, interest rates, cryptocurrency CFDs plus major, minor and exotic FOREX pairs.

They also provide CFDs on some very unique markets such as IPO grey markets, Bitcoin, and ETPs (Exchange Traded Products).IG Live Spreads

Losses can exceed deposits

Prices are indicative only -

IG now add share trading to their wide range of products. Over 12,000 shares available from Australia, US, UK, Germany and Ireland. Commission starting at AU$8 on Australian shares and US$10 on international however you need to open a separate share trading account.

-

Weekend Trading

IG allow clients to trade four of the most popular indices (Germany 30, FTSE, Hong Kong HS50 and Wall Street) out-of-hours on a Sunday. Sunday trading is available from 7pm on Sunday to 9.40am AEDT every Monday. It is important to realise that your weekday positions on the Germany 30, FTSE, Hong Kong HS50 and Wall Street will not be affected by Sunday trading.This concept however, allows you to offset ‘standard’ weekday positions, reducing your margin requirement and risk, if important news is released during the weekend.

IG allow clients to trade four of the most popular indices (Germany 30, FTSE, Hong Kong HS50 and Wall Street) out-of-hours on a Sunday. Sunday trading is available from 7pm on Sunday to 9.40am AEDT every Monday. It is important to realise that your weekday positions on the Germany 30, FTSE, Hong Kong HS50 and Wall Street will not be affected by Sunday trading.This concept however, allows you to offset ‘standard’ weekday positions, reducing your margin requirement and risk, if important news is released during the weekend. -

IG Direct Market Access

Share CFDs have capability to run on the IG direct market access (also referred to as ‘direct access’ or DMA) option. Direct access trading enables you to trade directly into the order books of major equity exchanges. This brokerage model offers greater transparency and flexibility than regular over-the-counter (OTC) trading. Direct market access trading is also known as ‘L2’ or ‘Level 2’ trading.

Our IG review found an important finding for those wishing to trade IG direct market access CFDs. It is very important to realise if you wish to do IG DMA trading, you actually need to activate ‘DMA Equities‘ within IGMarkets web-based dealer platform (not many traders appear to be aware of this).

By default you’ll be trading on the regular over-the-counter (OTC) model, unless you’ve specifically activated DMA on your account. This does not mean that IG DMA prices are necessarily better than OTC (over-the-counter), as IG’s pricing technology is engineered to find the best available prices on both OTC and DMA models. Direct access to the markets can however give advanced traders greater visibility and flexibility.We have further detailed analysis of IG Markets DMA available here.

- Strong in-house IT development team providing great charting, innovative mobile price alerts, technical analysis alerts and a web API for those clients wishing to automate their trading

- Parent company has been operating for well over 40 years (18th November 2014 marked the 40th anniversary of IG) and are pioneers of financial derivatives trading online. IG Markets Limited (ABN 84 099 019 851) is a part of IG Group Holding, established in the UK in 1974, which includes several companies rendering financial services to both private traders and professional brokers

-

IG Group – Forex and CFD Provider Awards

IG Australia, also referred to as IG Markets AU, has won several awards in recent years including:

- #1 for Overall Satisfaction for CFDs & FX – Investment Trends 2015 & 2016

- Australia’s best mobile trading offering – Investment Trends Australia CFD Report Sept 2014 & 2015

- Best Forex Provider – Winner at The Bull ‘Stockies’ Awards 2014

- Best CFD Provider – Winner at The Bull ‘Stockies’ Awards 2014

- Australia’s largest FX provider – Investment Trends 2014 FX Report

- * World’s largest retail Contract for Difference provider by revenue (excluding Foreign Exchange). Source: Published financial statements (IG website February 2018)

- No.1 in Australia by primary relationships – Investment Trends: Contracts for Difference Report May 2016

- No.1 in Australia by primary relationships – Investment Trends: FX Report November 2016

[starbox id=6]

Contracts for Difference (CFDs) are a complex, leveraged financial product and requires a certain level of experience, so may not be suitable for everyone. CFD trading carries a high level of risk to your capital. Losses and exceed your initial deposit and therefore you must ensure you fully understand all the risks involved. If you are considering acquiring any of the financial products listed on this IG review web page, you should always read the Product Disclosure Statement (PDS) and other offer document/s before making any investment decisions. If you are unsure of the risks, or have any doubt whether you have sufficient financial resources or experience to trade these IG CFD products, you should take professional advice before trading.